Financial Sponsors Group

We're here to help

Jeff Thieman

- Managing Director, Group Head Financial Sponsors Group

- 615-687-3035

- [email protected]

Financial Sponsors Group

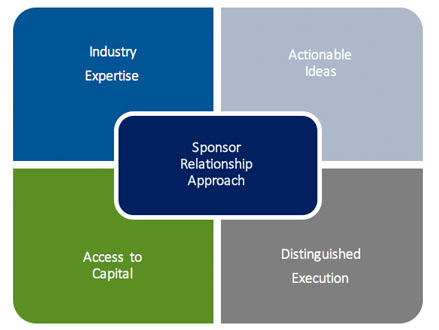

Fifth Third’s Financial Sponsors Group provides nationwide coverage to more than 150 of the most successful, middle-market private equity firms and family offices in the country. What is a financial sponsor? We believe a financial sponsor is a trusted partner who thinks beyond individual transactions, and adds value to clients’ investment strategies with innovative thinking and actionable ideas.

Our highly strategic advisory approach makes us uniquely qualified to deliver M&A, leveraged finance, loan syndication and equity franchise solutions to the financial sponsor community and their portfolio companies. As part of Fifth Third, financial sponsors investment banking partners with both industry and product teams to achieve consistently strong execution on behalf of our clients.

A Full Range of Advanced Capabilities

The Financial Sponsors Group provides a full suite of Capital Markets, Investment Banking and Corporate Banking capabilities across our clients’ investment life cycle:

- M&A Advisory – Buy-side, Sell-side and Recapitalization

- Debt Capital Markets – Loan Syndications, Investment Grade & HY Debt, Private Placements, Asset Securitization

- Leveraged Finance

- Financial Risk Management – Interest Rate Management, Foreign Exchange, Commodities

- Sponsor Lending Program – Subscription Loans

- Equity Capital Markets – IPOs, Convertibles and Follow-on Offerings

- Treasury Management

- Investment Management & Wealth Planning

Recent Transactions

Covanta Holding Corp., a Portfolio Company of EQT

Transaction Size: $1,875,000,000 | $1,500,000,000

Fifth Third Capital Markets Role: Joint Lead Arranger and Joint Bookrunner

Transaction Type: Senior Secured Credit Facilities | Senior Unsecured Bridge Facility

Industry: Diversified Industrials

Altus Power, a Portfolio Company of The Blackstone Group Inc.

Fifth Third Capital Markets Role: Administrative Agent, Joint Lead Arranger and Sole Bookrunner | Capital Markets Advisor*

Transaction Type: Secured Credit Facility | Capital Markets Advisory

Industry: Renewable Energy

US Anesthesia Partners, a Portfolio Company of WCAS and Berkshire Partners

Transaction Size: $1,850,000,000

Fifth Third Capital Markets Role: Joint Lead Arranger

Transaction Type: Senior Secured Credit Facilities

Industry: Healthcare

FR Refuel, a Portfolio Company of First Reserve

Transaction Size: $375,000,000

Fifth Third Capital Markets Role: Joint Lead Arranger, Joint Bookrunner & Co-Documentation Agent

Transaction Type: Senior Secured Credit Facilities

Industry: Consumer & Retail

ECP-PF Holdings Group Inc., a Portfolio Company of Towerbrook

Fifth Third Capital Markets Role: Financial Advisor

Transaction Type: M&A Advisory

Industry: Consumer & Retail

SKC Communications, a Portfolio Company of McCarthy Capital

Fifth Third Capital Markets Role: Financial Advisor

Transaction Type: M&A Advisory

Industry: Tech-Enabled Business Services

Komar Industries, Inc., a Portfolio Company of ONCAP

Fifth Third Capital Markets Role: Financial Advisor

Transaction Type: M&A Advisory

Industry: Industrials

Sauer Brands, Inc., a Portfolio Company of Falfurrias Capital Partners

Transaction Size: $125,000,000

Fifth Third Capital Markets Role: Administrative Agent, Left Lead Arranger, & Joint Bookrunner

Transaction Type: Senior Secured Credit Facility

Industry: Consumer & Retail

See More Transaction Highlights

*Executed by Fifth Third Securities, Inc.