Capital Markets Leadership

The Fifth Third Capital Markets Team has an average of 20+ years of experience in commercial banking. Our capital markets experts bring experience in market analysis, capital-raising solutions, and strategic counsel. The capital market department’s expertise combined with Fifth Third's comprehensive bank services offer truly integrated strategic advice and solutions. Learn more about Fifth Third Capital Markets by reading the leadership team’s bios.

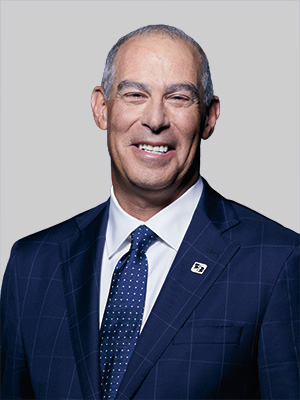

Robert Marcus

Executive Vice President

Head of Capital Markets

404-279-4522

[email protected]

As head of Capital Markets, Bob leads our Investment Banking, Debt and Equity Capital Markets, Tax Exempt/Municipal Finance, Fixed Income Sales and Trading businesses, Financial Risk Management which includes FX, Commodity & Interest Rate Management services and Financial Sponsor Coverage.

He joined Fifth Third in 2009 from Credigy Corporation (National Bank of Canada), where he led US Asset Origination. His 30 years of experience comprise leadership positions in Loan Syndications at Wachovia Bank, Debt Capital Markets Origination at SunTrust Robinson Humphrey and leading the Mid Corporate Restaurant and Retail Client Coverage Group at Citigroup

Bob earned a BA in economics from the University of Virginia and an MBA from Gouizeta School of Business at Emory University. Additionally, he is guest lecturer at the Darden School of Business at the University of Virginia where he coauthored a case that teaches acquisition finance.

Matthew Cannan

Managing Director

Head of Debt Capital Markets

312-704-7139

[email protected]

Matt joined Fifth Third Bank in 2006 and is head of Debt Capital Markets Origination. He has over 23 years of banking experience, primarily in loan syndications and leveraged finance.

Matt previously led the Loan Capital Markets team at Fifth Third, with responsibility for loan sales and trading, institutional loan investments and account coverage. His experience also includes syndicated and leveraged finance at J.P. Morgan and predecessor organizations, with a focus on the oil & gas industry.

Matt earned a BS in Finance from Indiana University.

Robert Schipper

Managing Director

Head of Investment Banking

404-279-4533

[email protected]

Rob is Managing Director and head of the Investment Banking group. He has over 20 years of experience advising public and private companies on mergers & acquisitions and capital raising transactions across industries including business services, consumer, technology, diversified industrial, among others. Under Rob’s leadership and strategic growth investment from the bank, the Investment Banking group has more than tripled in size over the past five years and is now one of the leading advisors in the middle market.

Additional experience includes J.P. Morgan’s investment bank, Jefferies Group, Robinson Humphrey and Bowles Hollowell Conner & Co.

Rob earned an MBA from the Darden Graduate School of Business Administration at the University of Virginia and a BS in Finance from the Commerce School at the University of Virginia.

Clayton Greene

Managing Director

Head of Equity Capital Markets

[email protected]

Clayton leads the Equity Capital Markets platform, which has witnessed significant growth year over year. Since the team’s inception in 2014, more than 130 transactions have been underwritten, raising over $93 billion in client proceeds.

Joining the bank in 2020, Clayton brings over 19 years of equity capital markets experience, most recently serving the New York Stock Exchange as Head of Consumer, Financial and Real Estate Capital Markets. Prior to joining the NYSE, Clayton spent 12 years as a member of Wells Fargo’s Equity Capital Markets platform originating and executing transactions across all industries.

Clayton has a BS in Business Administration from Villanova University.

Bob Tull

Managing Director

Global Head of Fixed Income, Currencies and Commodities

216-274-5702

[email protected]

As Managing Director & Global Head of FICC (Fixed Income, Currencies and Commodities) Bob is responsible for the origination, trading, distribution and business development strategy for the team. The business focuses on three primary pillars: the delivery of risk management products (interest rates, commodities and foreign exchange derivatives) to corporate and institutional clients, the origination of bonds & notes, and the sale of fixed income securities as well as liquidity management solutions to institutional investors.

Bob joined the bank in 2000. He is a member of the Bank of International Settlement’s Market Participant Group, which developed the FX Global Code. Bob is also a member of the New York Federal Reserve’s Foreign Exchange Committee, a member of the American Bankers Association Securities Board and was appointed to the Working Group on U.S. RMB Trading and Clearing.

Bob has a BA in Economics from The College of Wooster and a MBA from Baldwin-Wallace University.

Jeffrey Thieman

Managing Director

Group Head Financial Sponsors Group

615-687-3035

[email protected]

Jeff leads the Financial Sponsors Group and is responsible for a wide range of solutions for the middle market private equity community.

Since joining Fifth Third in 1999, he had a variety of roles that include credit/risk management, treasury management and distressed debt & restructuring. He was also previously led the Corporate Healthcare Banking group and healthcare sponsor leveraged finance business, including the bank’s healthcare sector vertical, distressed healthcare loan portfolio and sponsor leveraged finance.

Jeff earned a BSBA from Bowling Green State University.

Maria Yamat

Managing Director

Head of Bond Capital Markets

312-704-5912

[email protected]

Maria joined Fifth Third in 2010 to launch and lead the Bond Capital Markets Group. With over 20 years of experience originating and executing high-yield and investment-grade bond transactions across a wide range of industries, she has worked extensively with both mid cap and large cap issuers, raising debt capital ranging from $250 million to several billion dollars.

Maria has held senior positions in the debt capital markets groups at Wells Fargo Securities, Banc One Capital Markets and Banc of America Securities.

She holds a BBA from the University of Wisconsin-Madison and an MBA in finance and policy studies from the University of Chicago.

Additional Resources

Making Sense of Corporate Tax Changes

The Tax Cuts and Jobs Act of 2017 is the most significant retooling of the U.S. tax code in more than three decades. This is particularly true at the corporate level, where the thrust of the new code is to help U.S. companies be more competitive globally.

Workforce Trends and Their Impact on Businesses

What challenges are businesses facing today? And how does it impact you?

Industry Spotlight Reports

Fifth Third Investment Banking is pleased to provide you with the latest Industry Spotlight Reports. These reports highlight recent transaction and market data as well as key industry trends and analysis.