Welcome toA Fifth Third Better® Banking

Free checking, easy account setup, faster access to your pay, plus SmartShield™ Security—get all this and more with Fifth Third Momentum® Checking.

Whether you’re looking for a free checking account or one that earns you interest, discover the benefits of personal checking accounts from Fifth Third Bank. When you need to bank-on-the-go, all types of checking accounts can be accessed conveniently through the Fifth Third Mobile Banking app. Easily compare checking accounts below and find the best checking account for you.

| Fifth Third Momentum® Checking Start working towards long-term financial wellness |

Fifth Third Preferred Checking® Unlock an upgraded experience with exclusive perks |

Fifth Third Express Checking Simplify your finances and solidify your foundation |

|

|---|---|---|---|

| No monthly service fee | |||

| No minimum balance | |||

| Identity theft monitoring options12 | |||

| Complimentary Fifth Third Identity Alert®12 | |||

| Check writing | |||

| Over 40,000 fee-free partner ATMs13 | |||

| Online Bill pay8 | |||

| Dedicated banker | |||

| Ready to apply? | Open Your Account |

Traditional Checking Account:

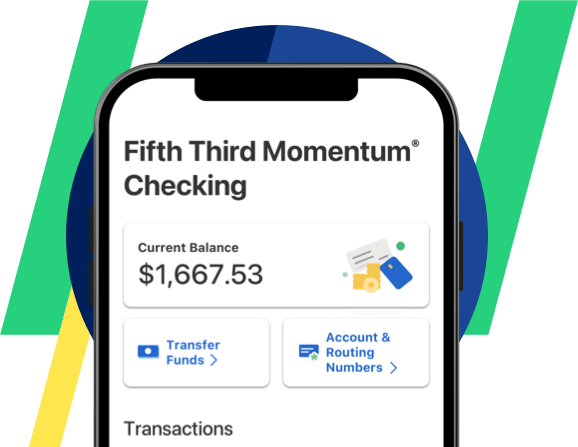

Fifth Third Momentum® Checking

Fifth Third Bank’s featured, most popular checking account. All the benefits of a checking account with no monthly service charge. That’s right, a free checking account! Plus, get additional time to make a deposit and avoid overdraft fees!

Fifth Third Momentum® Checking

Fifth Third Bank’s featured, most popular checking account. All the benefits of a checking account with no monthly service charge. That’s right, a free checking account! Plus, get additional time to make a deposit and avoid overdraft fees!

Account Details:

- No minimum balance required.

- No minimum deposit to open your account.1

- Fifth Third Extra Time® gives you more time to make a deposit and avoid overdraft fees (anytime before midnight ET the next business day).9

- No Overdraft Protection transfer fee.10

Key Benefits:

- Free checking account.

- Enjoy unlimited check writing.

- 24/7 mobile and online banking.

- Earn your paycheck up to two days early, without a fee, with Early Pay.11

- Get a cash advance on your next qualified deposit with MyAdvance®.6

- Avoid overdraft fees with Extra Time®.9

Specialty Checking Accounts:

Fifth Third Preferred Checking®

Join this exclusive program to earn higher interest on your checking account and get preferred discounts, benefits and services.

Fifth Third Preferred Checking®

Join this exclusive program to earn higher interest on your checking account and get preferred discounts, benefits and services.

Account Details:

- Service charges waived if you achieve a combined total balance of at least $100,000 across your deposit and investment accounts one time per month.2

- Otherwise, it's $25 per month.

Key Benefits:

- Unlimited check writing.

- Secondary checking account.

- Better loan rates.

- Complimentary Fifth Third Identity Alert®.12

- Online bill pay.8

Fifth Third Student Checking Account

A personal checking account for kids or students – age 13 and up.

Fifth Third Student Checking Account

A personal checking account for kids or students – age 13 and up.

Account Details:

- No minimum deposit to open your account.1

- No minimum balance required.

Key Benefits:

- Fifth Third Debit Card.

- Unlimited check writing.

- Online bill pay.8

Fifth Third Military Checking

For military families, including active duty, retired, reserve/guard and veterans. Also includes commissioned officers of the Public Health Service and the National Oceanic and Atmospheric Administration.

Fifth Third Military Checking

For military families, including active duty, retired, reserve/guard and veterans. Also includes commissioned officers of the Public Health Service and the National Oceanic and Atmospheric Administration.

Account Details:

- No monthly service charge when you open a Fifth Third Momentum® Checking account.

- $5 discount on the monthly service charge if you open a Fifth Third Preferred Checking account.3

Key Benefits:

- Special VA Home Loan rates.

- 10 free non-Fifth Third ATM transactions per month.

- Online bill pay.8

Fifth Third Express Banking®

Get all the advantages of a secure, easy-to-access bank account, with built-in safeguards to help you manage your money better.

Fifth Third Express Banking®

Get all the advantages of a secure, easy-to-access bank account, with built-in safeguards to help you manage your money better.

Account Details:

- $5 monthly service fee.

- No balance requirement or overdraft fees.

Key Benefits:

- Check cashing and deposits.7

- Immediate access to your money.7,8

- Earn your paycheck up to two days early, without a fee, with Early Pay.11

- 24/7 mobile and online banking.8

- Fifth Third Debit Card.

- Tools to build your credit.

Fifth Third ABLE Checking

Allows individuals with disabilities and their families to save for future qualified expenses without losing access to federal benefits.4 Available through participating state plans.

Fifth Third ABLE Checking

Allows individuals with disabilities and their families to save for future qualified expenses without losing access to federal benefits.4 Available through participating state plans.

Account Details:

- Service charges waived if you have an average monthly balance of $250 or more during your statement cycle, or if you sign up for paperless statements.8

- Otherwise, it’s $2.00 per month.

Key Benefits:

- Fifth Third Debit Card.

- Unlimited check writing.

- No overdraft or non-sufficient funds fees.

- Tax advantages: Pay no taxes on interest earned or on withdrawals used for qualified expenses.5

Personal Checking Account Help Center

Checking Account FAQs

Explore other Top Personal Banking FAQs and Debit Card FAQs.

Additional Resources

Questions to Ask When Opening a Checking Account

Here are questions to ask your banking representative about checking account fees, minimum balance, and mobile apps.

How Much Should You Keep in Checking vs. Savings?

It's important to understand the difference between your checking and savings accounts. Here are the differences and the best way to utilize both.