Aerospace and Defense Industries Riding Tailwinds

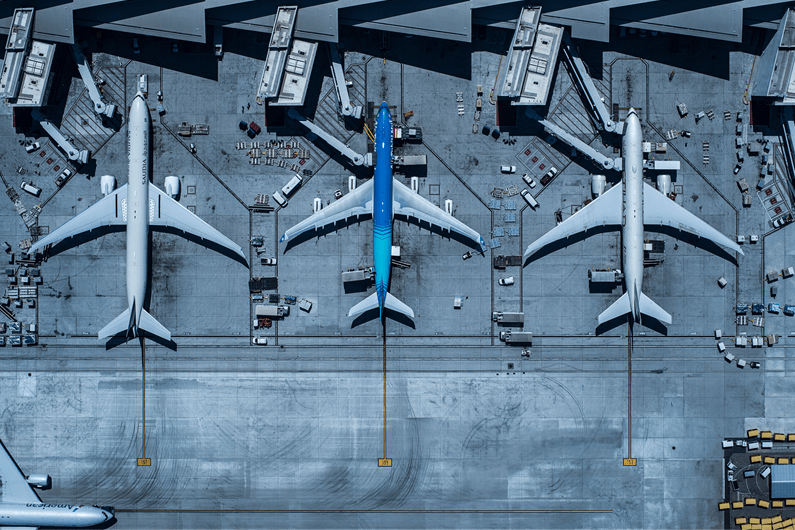

A&D industry demand surges amid upswing in travel and global conflicts.

An unusual confluence of economic and geopolitical events is benefiting civilian aerospace companies and defense contractors.

On the civilian side, a resilient U.S. economy has led to a surge in consumer demand for upscale tourism experiences that often include air travel. Simultaneously, conflict in Europe and the increased saber-rattling in Asia have resulted in strong demand for next-generation military hardware.

For the aerospace and defense industries, "there are significant tailwinds behind these industries, and we do not see them abating in the near future," says Pete Samboul, Group Head of Aerospace, Defense, and Transportation (ADT) Corporate Banking at Fifth Third Bank. "These trends should have considerable staying power and represent opportunities for aviation and defense industry suppliers."

Demand for Air Travel Remains Elevated

Samboul noted that many travel experts had correctly predicted a surge in travel after the lockdowns of the pandemic, but had been wrong in estimating that airline reservations would begin to level off once the global economy got back on its feet. Instead, U.S. passenger volume has surpassed pre-pandemic 2019 levels and only 4% below the all-time high set in January 2020, with corresponding profitability for U.S. airlines.

United Airlines’ third-quarter 2023 earnings were up 29.9% year-over-year, and it wasn’t alone in posting favorable financial results. For the major U.S. airlines as a group, operating losses of $5.4 billion in the year ending with the first quarter of 2022 turned into operating profit of $15.8 billion for the 12 months ending with the first quarter of 2023, according to U.S. government data.

The surge in demand has created strong order flows for new, more fuel-efficient aircraft at Boeing and Airbus, the world’s two most prominent commercial airplane manufacturers, and produced backlogs of epic proportions: 4,928 planes at Boeing, 7,959 at Airbus.

The civilian aerospace industry’s growth is not confined to traditional commercial aircraft, as growth has also been noted in the future air mobility sector, which includes drones for deliveries and zero-emissions aircraft. This sector has orders for more than 18,000 aircraft, tallying some $111 billion in sales, according to consulting firm McKinsey & Co. McKinsey added that the sales volume is expected to exceed that of traditional commercial aviation.

"Older planes are in the air, but the airlines would love to increase their fleets’ fuel efficiency with newer versions," Samboul said. In addition, increased public and investor attention on environmental, social, and corporate governance issues has put a premium on SAF, or sustainable aviation fuel, the renewable energy of the aviation-power space, as Samboul put it.

Supply Chain Issues

Engine technology advancements are having trouble keeping up with the latest developments in the rest of an airplane, and supply chain issues caused by the COVID-19 pandemic have not been fully resolved, leaving existing airplanes and their engines in use for longer-than-desired periods of time. Neither Boeing nor Airbus expects production to normalize at pre-pandemic levels until well into 2024 or possibly into 2025.

With the current fleet of passenger planes still in service past originally planned retirement, a resulting increase in degradation is leading to an uptick in maintenance cycles and fewer hours in the sky. At Delta, for example, engine-maintenance turnaround time is up 20%, external third-party airframe checks are taking 30% longer, and it’s taking 30% longer to get components. (Conversely, this should be a boon to the maintenance and repair organizations, or MROs, that service older-generation planes.)

The supply chain situation is not all negative, however, Samboul said. Compared with the height of the pandemic, it has improved dramatically, even boosting the secondary market for airplanes, similar to what occurred in the automobile industry with used cars.

Samboul said that while supply chain problems continue to represent some risk to the aerospace industry, they should be less of a drag on production as the situation continues to normalize in the future.

Military Spending Rises

For the defense industry, geopolitical tensions in Europe, the Middle East, and Asia are leading to increased military spending in many countries, including those in the North Atlantic Treaty Organization (NATO). Since the Ukraine conflict began, NATO in its entirety has raised defense spending by 8%, adjusted for inflation, amounting to four times the rate of increase in 2022. In the United States, Congress has been working on an $886 billion defense budget for fiscal year 2024, which would mean absolute defense spending rising somewhere between 3.2% and 3.6% from the prior fiscal year. Germany, which has been reluctant to invest much on its armed forces since World War II, is now set to spend around $8 billion on 35 F-35 Lightning II aircraft as part of a $14 billion set of procurements announced to enhance military capabilities, drawn from a $107 billion defense fund set up after Russia’s invasion of Ukraine.

U.S. defense companies, such as Lockheed Martin, the builder of the F-35, are especially set to benefit from the escalation in spending, as they manufacture many of the weapons in high demand globally, with many allied countries replacing older-generation fighters with the F-35. When the United States awarded contracts worth $2.2 billion to Boeing for aircraft tankers, the company also received orders from Japan and Israel.

The demand for new military material isn’t expected to conflict with demand on the civilian side, which has greater latitude in subcontracting and parts procurement than the military does due to U.S. Department of Defense regulations. Furthermore, the two industries aren’t competing over the same component parts. Much of the attention in the military procurement market is focused on new technologies, especially drones, whether used as data collectors in reconnaissance or as tactical assault weapons that are replaced after every use, Samboul says.

Along those lines, the Pentagon’s command that focuses on China has submitted a $15.3 billion plan to purchase missile defense systems, radars, and space sensors for operations in the Pacific, and to fund an expansion of exercises and training for that region.

The plan contains a $5.3 billion request for "persistent battlespace awareness," which includes funding for the next generation of an infrared-technology network of satellites focused on missile defense and space-based sensors that look for missile threats from land, sea, or air, according to news outlet Breaking Defense.

Nontraditional Contractors

The most recent version of the National Defense Strategy focuses on emerging technologies including artificial intelligence, space technology, and biotechnology. These new weapons include hypersonic missiles, which can travel at between five and 25 times the speed of sound. Contractors are developing an Internet of Military Things, including remote sensors and directed energy weapons which use high-energy lasers or powerful magnets.

A new group of nontraditional defense contractors is increasingly behind the development of these next-generation technologies. For example, the U.S. Defense Department awarded contracts for the new Mayhem-class hypersonic missiles to information technology firm Leidos and its partner Kratos Defense & Security Solutions, two smaller groups that have heavily invested in research and development but aren’t yet household names.

With future conflicts expected to hinge on reconnaissance, intelligence analysis AI will likely become of increasing importance. That has opened up a role for the biggest tech companies, such as Microsoft and Google, not normally thought of as defense firms, to become major Pentagon contractors.

Digital transformation is a recurring theme behind many of the advancements in aerospace and military technology. Digital transformation incorporates Big Data, AI, and machine learning to improve proof-of-concept testing, and to design more efficient and more cost-effective production and maintenance lines. Until supply chain constraints are fully eliminated, the latter will be especially important, saving the aerospace and defense sectors billions of dollars while shortening delivery times.

For all Aerospace, Defense, and Transportation needs, contact Pete Samboul at 310-734-5151.