Benefits of Real-Time Payments: A Competitive Edge

Instant payments are favored by consumers for ease and speed when shopping.

Real-time payments, also known as instant payments, have been growing in popularity in recent years, driven by consumers looking for instantaneous, secure, and convenient transactions.

With the rise of platforms, consumers are no longer satisfied with traditional payment methods, like ACH, that can take days to clear. Even with so-called "fast" payments, like credit and debit cards, there is a delay between when the transaction occurs and the settlement is finalized.

This demand for instant payments has prompted businesses and financial institutions alike to focus on accelerating the pace of financial transactions. The Clearing House’s Real-Time Payments network is currently partnered with 235 banks, covering over 60% of demand deposit accounts across the country. According to Fact.MR’s analysis, this demand is expected to keep rising, with The American Banker reporting a predicted compound annual growth rate of 33% over the next decade and a yearly volume of $277 billion by 2032.

Doing this the right way has required financial institutions to implement new tools to mitigate fraud and ensure businesses and consumers can use these payments with confidence. In addition, US Faster Payment networks—The Clearing House’s RTP Network—are continually refining their rules and adding new solutions to protect businesses and their customers.

"Faster payments are accelerating the future of financial transactions. They provide our clients with the speed and security necessary to support the evolving needs of their clients. As instant payments become more widespread, we anticipate seeing diverse and innovative uses in everyday business operations. That’s why at Fifth Third Bank, we are committed to providing our clients with payment solutions to stay ahead in today’s fast-paced environment," said Bridgit Chayt, Head of Commercial Payments & Treasury Management at Fifth Third Bank.

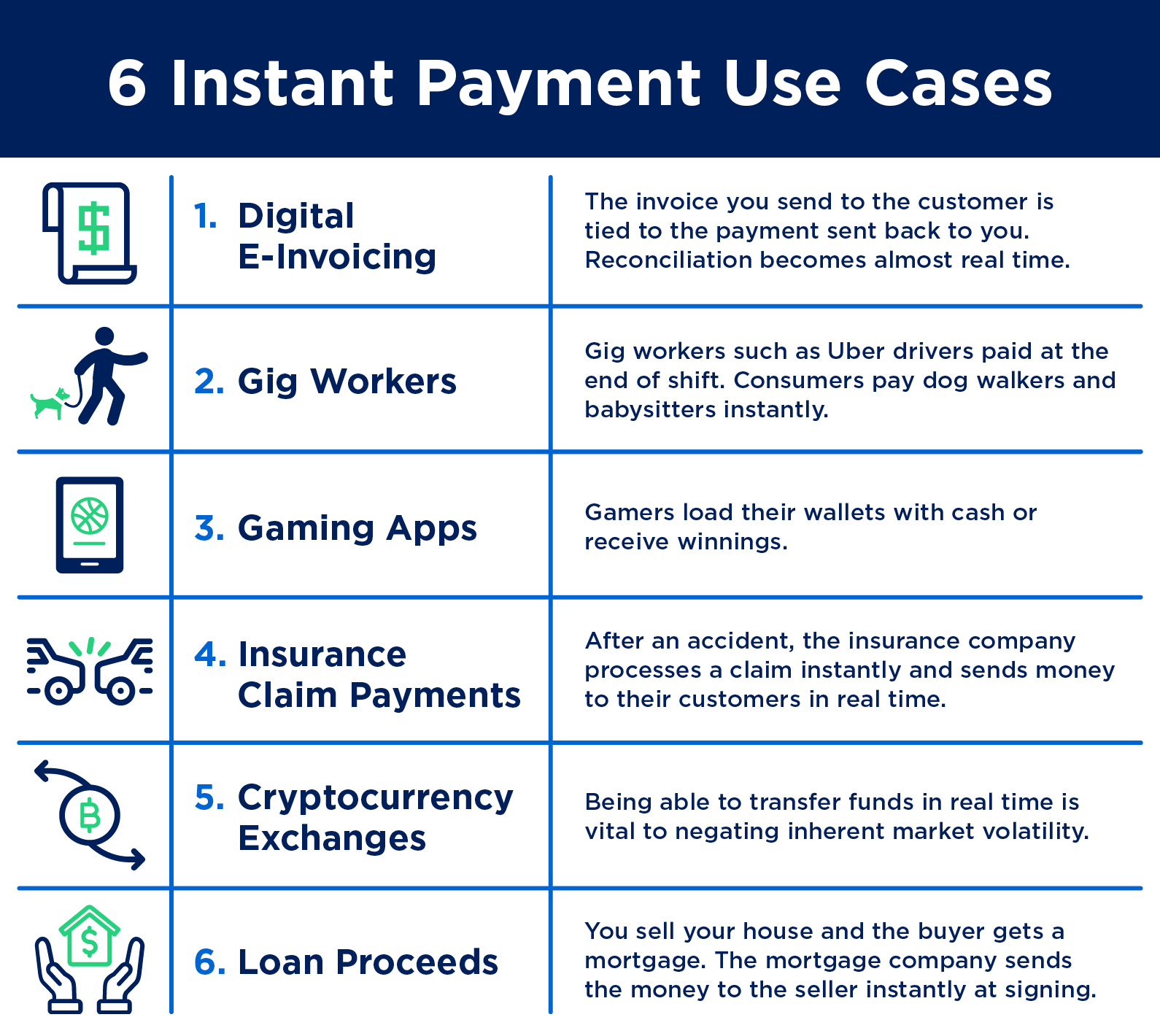

See infographic transcript below

The growing adoption of instant payments will bring about significant opportunities for businesses of all types. For small and medium-sized organizations, real-time payments can enable better cash flow and make it easier to manage day-to-day operations by improving liquidity. Brokerage services, meanwhile, will benefit from the ability to perform stock sales faster.

The industries that stand to benefit the most, however, are those where there is a clear material advantage to releasing funds as quickly as possible. One such case is in the gaming world, where platforms offering instant payouts will be considerably more popular with consumers. Similarly, for point-of-sale purchases, real-time transfers will not only enhance consumer experience, but reduce costs for merchants as well.

Other early use cases have shown that real-time payments can have an even more profound impact. In the insurance industry, for example, instant payments have enabled companies to settle claims immediately, which could potentially create an entirely new business model.

"We’re hearing that some of the insurance companies today have real-time claims where you can take a picture of the accident with your phone and they can adjudicate the claim while you’re on the phone with the representative," said Chayt. "With real-time payments, they can then be in a position to push money to their customers in real time such that when people are walking away from the accident scene, they actually have money in their account to go buy a replacement vehicle."

Real-time payments will eventually become so common that they won’t need to be referred to as “instant payments” anymore, as customers abandon slower payments systems in favor of getting paid with the click of a button.

To learn more about this and other treasury tools, contact your Fifth Third relationship manager or to learn more.