Fifth Third ABLE Checking Account

Achieving a Better Life Experience with ABLE Checking

Achieving a Better Life Experience, or ABLE, accounts are state-sponsored savings and investment accounts that allow individuals with disabilities and their families, to save and invest private assets for disability-related expenses without losing, or losing access to, federal means-tested benefits, such as Supplemental Security Income (SSI), Medicaid, HUD, SNAP and other benefits.1

ABLE Checking cannot be opened in a Fifth Third Branch. To get started, contact a participating state plan.

What are ABLE Accounts?

ABLE Accounts allow for people with disabilities to create tax-advantaged savings accounts. The funds in ABLE accounts can be used for qualified disability-related expenses, such as housing, transportation, and education.

With Fifth Third ABLE Checking, there’s no monthly service charge if:

- You have an average monthly balance of $250 or more during your statement cycle.

- OR sign up for paperless statements.

Otherwise, it’s $2.00 per month.

ABLE Account Benefits

- Receive a specialized notched ABLE Debit Card from Fifth Third Bank

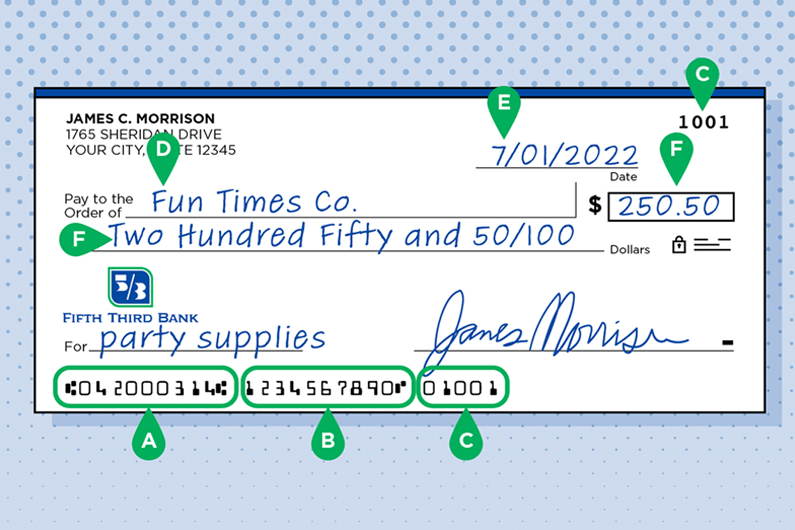

- Enjoy unlimited check writing

- No overdraft or non-sufficient funds fees

- Account balances earn interest2

- FDIC insurance up to maximum amount permitted by law

- Tax advantages:3 Pay no taxes on interest earned or on withdrawals used for qualified expenses4

- Access to balance and transaction activity through Online and Mobile Banking services

- Fifth Third Instant Alerts: Get immediate information on account and online security and instant notices for card and spending activity

- Monthly paper or online statement options

- Access to 40,000 fee-free partner ATMs5

What Can ABLE Accounts Be Used For?

Qualified ABLE expenses include, but are not limited to:3,6

- Education

- Health and wellness

- Housing

- Transportation

- Legal fees

- Financial management

- Employment training and support

- Assistive technology

- Personal support services

- Oversight and monitoring

- Funeral and burial expenses

Receive a Secure ABLE Debit Card

As with any Fifth Third Bank checking account, the ABLE Checking Account comes with a secure, notched debit card.

- The notched debit card assists our visually impaired customer to easily identify the card and helps ensure the card inserts correctly into ATMs and PIN pads

- ABLE debit card allows easy access to your ABLE checking account

- Use the debit card to pay qualified ABLE expenses such as education, health and wellness, housing, transportation, and more

How do I make a transaction with a notch debit card?

Making a transaction at a terminal is easy:

Identify notch card

Identify the card in your

wallet with the notch cut out

to make your transaction.

Insert your card

Turn the card so that the notch

is toward you and insert the

opposite end of the card in the

chip card reader or ATM.

Provide PIN as promoted.

Or, swipe your card

If the terminal doesn't accept

the chip, turn the card with the

notch facing away from you to

swipe using the magnetic strip

on the back of your card.

ABLE Debit Card FAQs

Current Interest Rates for the ABLE Checking Account

The below rates are effective as of 9/1/2023.

| Balance | Interest Rate | APY2 |

|---|---|---|

|

$0.01 - $9,999 |

0.01% |

0.01% |

|

$10,000 - $24,999 |

0.01% |

0.01% |

|

$25,000 - $49,999 |

0.01% |

0.01% |

|

$50,000 - over |

0.01% |

0.01% |

Where Does Fifth Third Offer ABLE Checking?

Fifth Third is proud to offer ABLE Checking as part of these state plans:

For questions specific to the Fifth Third Bank ABLE Checking option, call 1-888-516-2375, Monday–Friday, 8 a.m.- 6 p.m.; Saturday 10 a.m.-4 p.m. EST.

STABLE Plan Support

Fifth Third also supports Ohio’s STABLE plan through a savings option and custodianship of plan assets.

Additional Resources

6 Benefits of Having a Checking Account

Checking accounts allow you to conduct many types of everyday transactions, both in person and online. Using your checking account, you can deposit money, transfer funds to other accounts (both yours or other people’s), withdraw cash, and write checks.