Welcome to the

Young Bankers Club!

teaches students math and life skills with the help of

Maximillion MoneyTM.

Meet Maximillion Money TM

He’s president of the Young Bankers Club and the richest kid in America. He’s also your students’ guide through an engaging, interactive online curriculum that’s a breeze for teachers to use, and a blast for kids to play.

A better way to learn

better Financial habits.

While the US is home to the world’s largest economy, our financial literacy rates are lagging behind. That’s why we’ve reimagined our proven financial literacy for kids lessons to be more interactive, more engaging, and available to more students than ever before. Because at Fifth Third, we’re always looking for new ways to deliver even better experiences.

WATCH THE VIDEO TO LEARN MORE

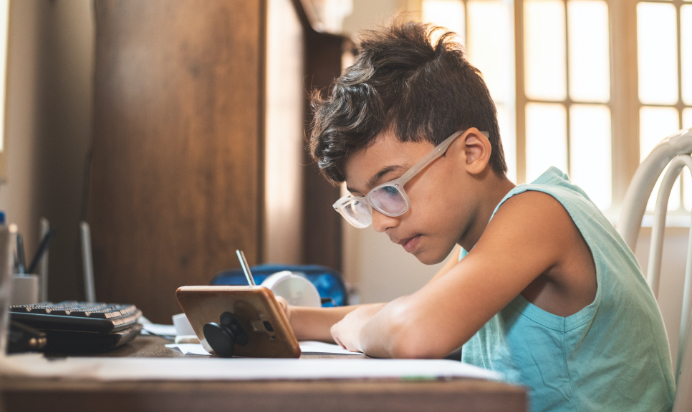

See how learning better financial habits can help students early.

Reimagined for modern classrooms

The Young Bankers Club Maximillion Money™ Financial Education Program has been redesigned to deliver an accommodating experience that educators can incorporate into any learning environment.

Greater Accessibility

Greater Flexibility

Up-to-Date Education

The Young Bankers Club Maximillion MoneyTM Financial Education Program:

Curriculum That Makes Learning Fun

Students will be presented anywhere from six to eight modules based on their grade level. Each lesson in our module-based financial education program provides a unique, engaging approach to financial literacy that meets students where they’re at, and helps them apply their knowledge to gradually more complex scenarios. The program incorporates different facets of banking, while clearly identifying the relevant math content standards within each unit—outlining what students should know, and be able to use.

4th to 6th Grade Common Core Standards for Mathematics

- Operations & Algebraic Thinking

- Numbers & Operations in Base Ten

- Numbers & Operations—Fractions

- Measurement & Data

- Geometry

- Ratios & Proportional Relationships

- The Number System

- Statistics and Probability

Jump$tart and Council for Economic Education National Standards in K-12 Personal Financial Education

- Spending and Saving

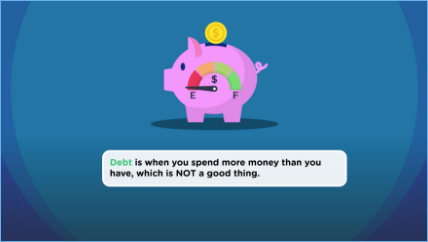

- Credit and Debt

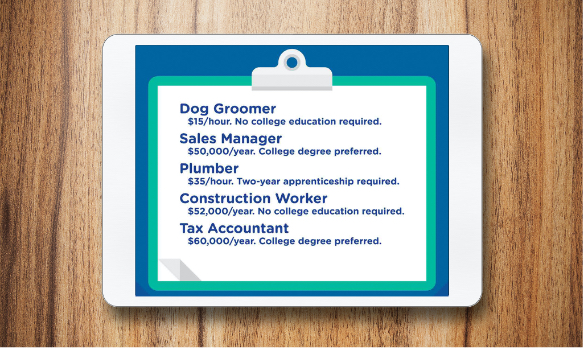

- Employment and Income

- Investing

- Risk Management and Insurance

- Financial Decision Making

Real World Application

- Problem Solving

- Reasoning and Proof

- Communication

- Connections

- Representation

Lessons that Help Students Succeed

To progress through the game, students work with Maximillion MoneyTM to solve real-world problems using their financial know-how. Each lesson represents a "level," and focuses on important aspects of personal financial literacy for kids including:

Learn About Money

Budgeting

Payment & Banking Methods

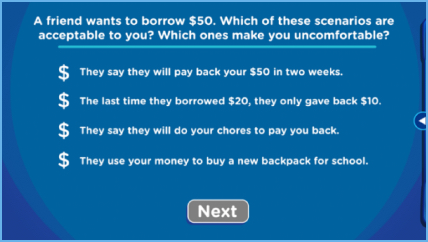

Overspending & Lending to Others

Borrowing Money

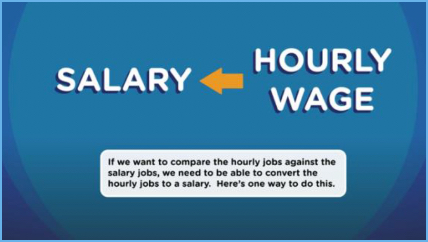

Jobs & Income

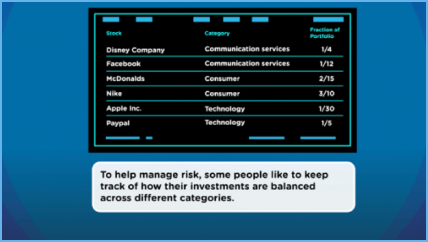

Saving & Investing

Protect Your Money—Risk & Insurance

Getting Started

Enrollment for Teachers, Instructors, Educators, and Admins:

- Click the enrollment button below or at the top of the page to begin your enrollment process.

- Create a username and password. Your default ID is your email address.

- Enter the school data, classroom information, and student roster information.

- Submit your request, our Fifth Third Activation Team will review for approval.

- You'll be notified of approval by email, which provides access to the portal.

- Teachers can add or edit their student roster as needed.

Students cannot enroll themselves. Teachers must enroll classroom students.

Login for Students:

Log in to the Young Bankers Club portal using assigned user ID and password.