Sale-Leaseback: Unlock Equity Tied Up in Real Estate

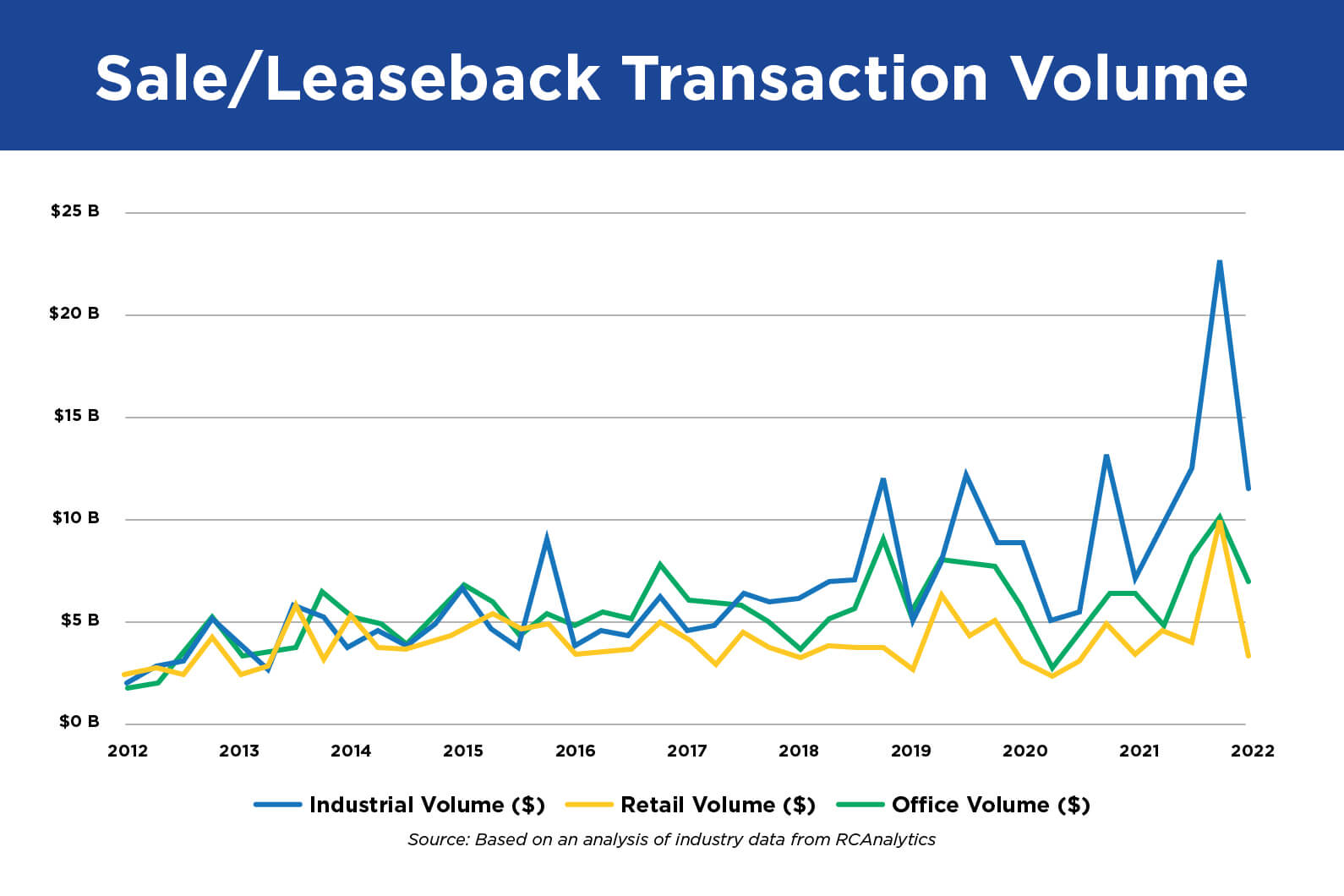

Limited supply and investor demand is driving record-high pricing in select asset classes.

Businesses looking to access capital for a variety of needs are finding a lucrative source through sale-leaseback (SLB) transactions. In most cases, businesses that are not focused on owning real estate for a profit can find higher returns on their equity outside of real estate.

Both private and public companies have a long history of leveraging sale-leaseback structures as an alternative to traditional mortgage financing. In an SLB, a business sells a real estate property or portfolio of properties, and at the same time executes a long-term lease to occupy the property or portfolio. Effectively, the business is transitioning from the role of property owner to tenant.

One of the key benefits to an SLB is that it allows a company to fully monetize its real estate assets, meaning that it can pull out all of its equity while maintaining operational control versus keeping in 20%-40% as is typically required with a traditional mortgage.

Sale-Leaseback Arbitrage Value

Many middle-market companies don’t realize the true value of the real estate owned under today’s market conditions for SLBs. Unlike the value generally placed on real estate that is "owner occupied"—how most companies value real estate held by the company—an SLB value can be worth significantly more. The underlying cause for this arbitrage of values is due to the increased weight given to the seller’s (future tenant’s) credit by an investor in an SLB transaction.

For example, a logistics company that owns a portfolio of distribution facilities valued at $50 million on its books based on a recent mark-to-market of similar properties, could be worth $75 million to a sale-leaseback investor leveraging the financial strength of the logistics company as its long-term tenant.

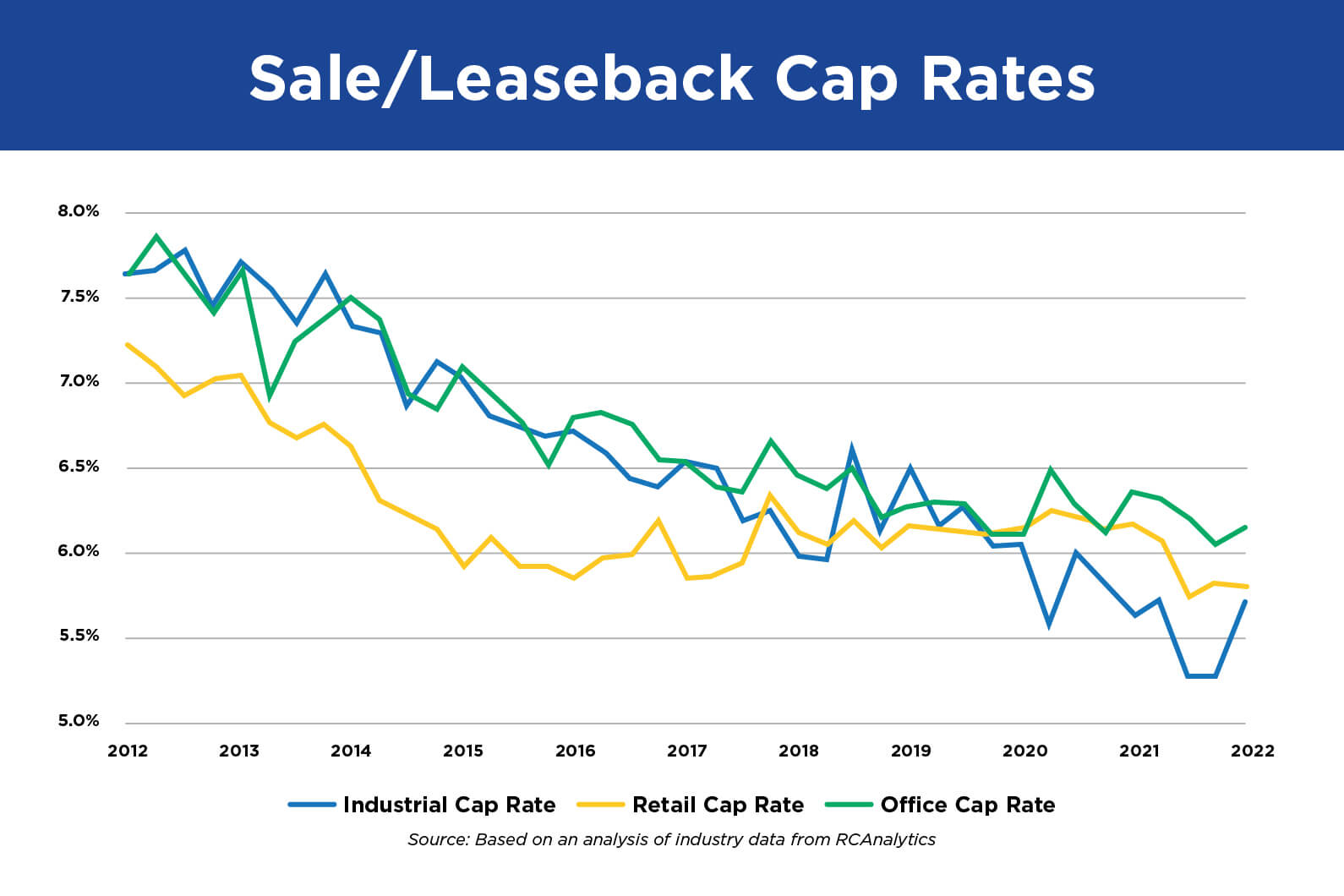

This difference is driven by the underwriting fundamentals of an SLB investor compared to a typical real estate investor. An SLB investor is a passive real estate owner looking for long-term, secure returns that are usually protected against inflation through modest annual rent increases. These investors are willing to pay lower cap rates (i.e., higher prices) for SLBs the stronger the business’ perceived credit.

"In a lot of cases, companies may not realize that they have too much money tied up in an underperforming asset," said PJ Camp, Managing Director and Head of Real Estate Investment Banking at Fifth Third. "Sale-leasebacks allow companies to take that equity out of the real estate and invest it elsewhere where they can generate a higher return."

The economics alone create a compelling reason to do a sale-leaseback. Layering on top of that are current market conditions that feature strong buyer demand, relatively low-interest rate environment and lack of supply, producing premium pricing for high-demand real estate asset classes.

Transcript available below graphic

Evidence of strong investor demand for real estate assets is clear in the recent record-high transaction activity and pricing. Commercial and multifamily real estate sales rose to a new annual high of $808.7 billion in 2021, well ahead of the pre-pandemic total of nearly $600 billion achieved in 2019, according to Real Capital Analytics. Commercial property prices also have reached new highs in almost every property type. Real Capital Analytics’ U.S. CPPI National All-Property Index for December jumped 22.9% year-over-year for all property types.

Although accessing capital is the primary driver behind most SLB transactions, other key benefits to an SLB include:

- Fully monetizing company value when a SLB is combined with a larger M&A transaction.

- Maintaining control of the property through a long-term lease.

- Tax advantages. Tenants can deduct their full rent payment as a business operating expense.

According to Fifth Third’s Managing Director and Head of Investment Banking, Rob Schipper, "The biggest driving factor to do a sale-leaseback right now is the arbitrage in the market." As an example, he said most operating companies are trading at an 8-12x multiple of their earnings before interest, taxes, depreciation and amortization (EBITDA). But an SLB of a property that generates a 5% capitalization rate, which is the net operating income divided by the cost of the building, translates to a 20x multiple.

Transcript available below graphic

"As you look at placing dollars into different buckets, what’s going to get you the maximum value? That arbitrage is a strong incentive for companies to sell their real estate," Schipper said.

Is a Sale-Leaseback the Right Fit for You?

An SLB is an equity-raising strategy that companies pursue for a variety of reasons. For some companies, 50% or more of the value of the company may be locked in its real estate. Capital tied up in occupied real estate typically increases in value by about 2%-3% per year.

Oftentimes, companies opt to complete an SLB transaction to finance an acquisition or reinvest in their business, such as funding R&D, adding new business lines, or upgrading equipment. Retail and restaurant chains frequently use them as a way to finance development growth strategies. The most common reasons companies choose to execute an SLB include using the capital to finance M&A activity, business expansion, paying down debt, and business succession.

An SLB also can be a valuable tool in succession planning for a family-owned business, as it allows the owner to separate the real estate from the operating company, generate liquidity at a premium, and diversify for retirement.

A common factor holding companies back from conducting a SLB is the fear of loss of control over the asset. Companies can overcome that obstacle by structuring the lease to allow for long-term control and flexibility to run its business.

Best Practices for Maximizing Value

For companies considering an SLB, key steps that can help to maximize the value and ensure that the transaction aligns with business strategy include:

- Evaluate goals and objectives. Answer three key questions:

- Hire a professional experienced in valuing SLB transactions. There is underlying value in the real estate, but what drives the SLB market is a company’s credit profile. SLBs are often viewed in the investment marketplace as corporate bondlike assets because they are typically backed by companies that sign long-term leases of 10-15 years or sometimes longer. Investors are buying that steady cash flow and underwriting credit risk. As such, valuing an SLB transaction depends heavily on the corporate (seller and future tenant) credit profile.

- Take a targeted approach. Targeted marketing puts the opportunity in front of the right pool of potential buyers—investors that are actively acquiring in a particular sector and have a capital structure set up to target long-term, low-yield properties. It is also important to reach those buyers that have a good reputation for being able to execute and close on acquisitions.

- Use a highly structured, competitive bidding process. Multiple rounds of competitive bidding help to generate optimal offers. For example, Fifth Third recently represented a food distribution business that was planning to sell the company. Originally, they planned to sell the operating business and the real estate together to one buyer. The appraisal on the business resulted in an assessed value of the real estate, a cold-storage facility, at $45 million. The company then received an unsolicited offer from a real estate investor for a SLB valued at $56 million.

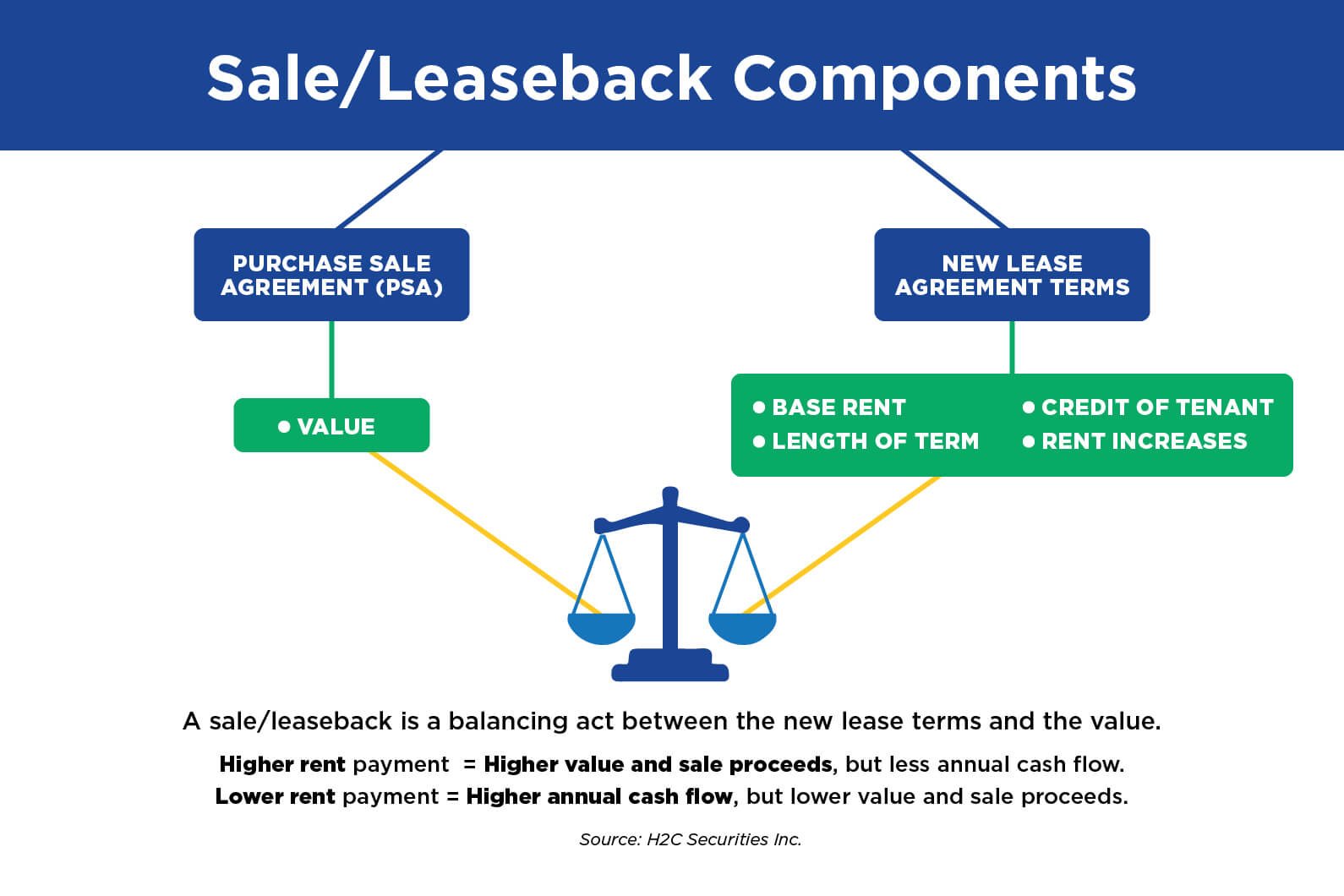

- Seek guidance on structuring terms and closing. There are different control measures that can influence pricing, such as rent and lease term. It is important to set the rent at a level that helps to achieve the highest value possible but not so high that it negatively impacts a company’s business operations and cash flow.

a. What are my capital needs?

b. What are my strategic plans for the company, and how might that impact my use of the property?

c. Does the facility functionally work for business operations in the short term and long term?

Answering those questions can help to determine if an SLB is the best course of action as well as provide guidance on the company’s goals and objectives. For example, if a company is thinking of exiting a particular location in the near future, it may desire a shorter-term lease or a termination clause.

The company decided to engage Fifth Third’s Real Estate Investment Banking team on the SLB, which was fully marketed and went through three rounds of competitive bids to maximize pricing. The final offer in the third round of bidding ended up at $77.2 million—$32 million more than the appraised value.

"This is an example of how sale-leasebacks can not only unlock value tied up in real estate but also how important the competitive bidding process is to maximize values," says Schipper.

Transcript available below graphic

When looking at SLBs, the best practice is to take a holistic approach. A common mistake that most real estate brokers make is looking at the value of the real estate in a silo. It is important to take into account real estate, credit profile, and an organization’s goals and objectives. It also is important to look beyond pricing metrics and make sure that there is a good cultural fit between the buyer and seller. "It’s like a marriage. The seller is going to have to live with that new owner as the tenant for 10-15 years,” says Schipper. "So, it is important to make sure there is a good cultural fit and alignment of goals between the buyer and seller."

For additional information, contact your Relationship Manager or contact [email protected] to learn more.