Middle Market Currency, Commodity Hedging

Extreme market volatility requires extra protection.

Nearly three years of remarkable economic volatility in commodities, currencies and now interest rates, have middle-market companies thinking longer and acting more quickly when it comes to hedging their risks.

"We’ve seen all kinds of things happen, but what we have mainly seen is this real push to look at longer-dated hedges versus short term," said Michael Orefice, Managing Director for Foreign Currency and Commodity Sales at Fifth Third Bank. "Clients have started to look at ways to help their business, not just today but into the future."

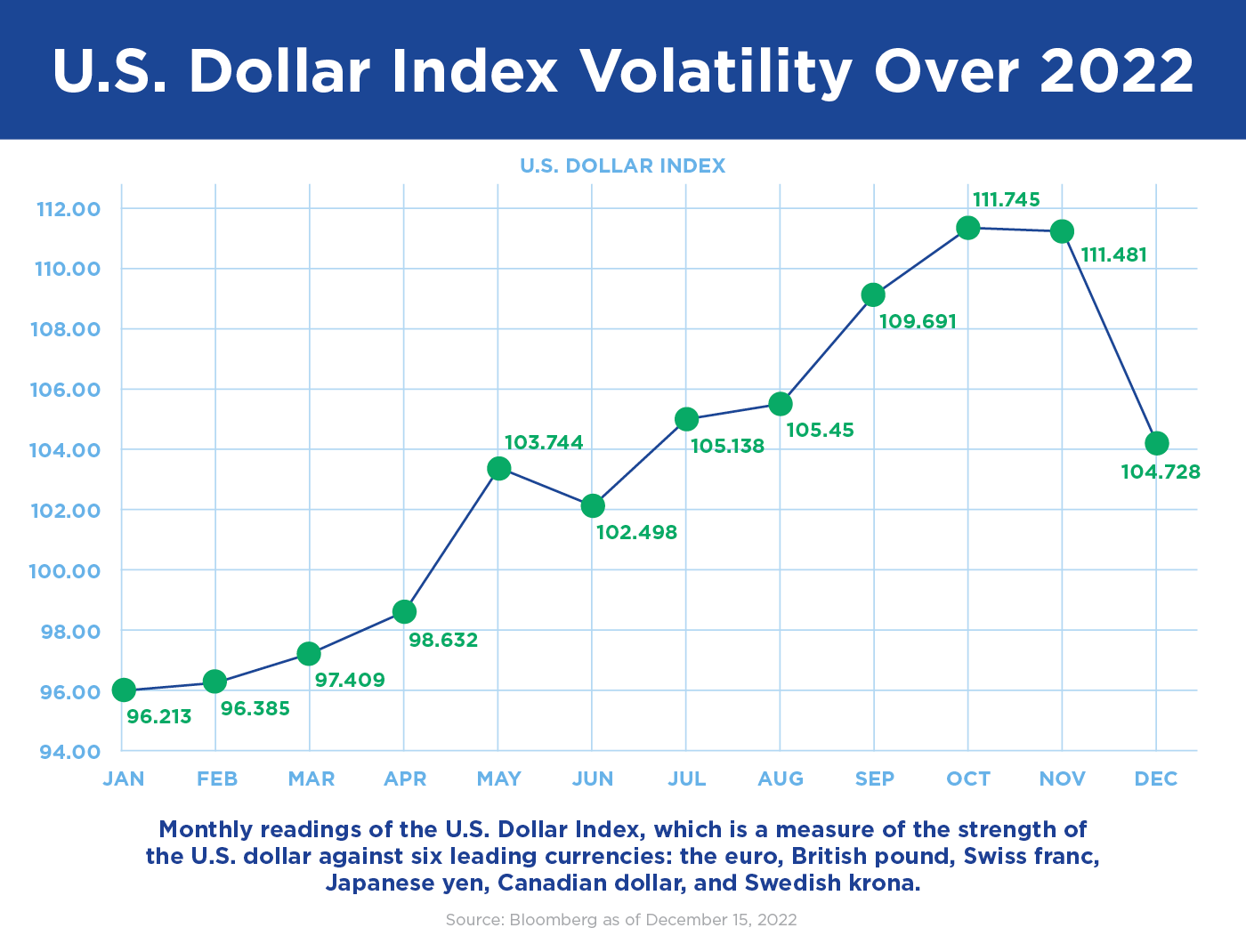

Consider that the U.S. dollar index, since the start of 2020, has risen 17% against a weighted basket of trading-nation currencies, to levels not seen since 2002. For a company that sells abroad, or conversely, imports equipment or components, that’s potentially a huge bottom-line impact.

Transcript available below graphic

The Strong Dollar

When the dollar strength is added to a period of unusually bouncy prices for commodities, and now more recently for borrowing costs, many a business’s viability could be on the line. The trick is to manage that exposure strategically as well as cost-effectively.

While large corporations in international markets often make use of hedge positions, even then they can face distortions in earnings due to a strong dollar alone. For example, software giant Microsoft said it suffered a $460 million hit to revenue because of "unfavorable exchange rate movement" in the dollar. Other companies such as Johnson & Johnson, Coca-Cola and Netflix also warned of lower sales because of the dollar strength overseas, a problem that also hits middle-market exporters squarely in their bottom lines.

On the other hand, U.S. manufacturers and other companies, such as retail or travel firms, that import products or pay for goods or operations abroad, but sell primarily to domestic customers, are enjoying a revenue tailwind thanks to the strong dollar.

For middle-market firms that may have devoted their internal resources to building sales and retaining those customers, adjusting to such factors can be uncertain territory.

"We’re starting to see more corporate treasurers, more CFOs, really take advantage of learning more about hedging," said Fifth Third’s Orefice, who noted the bank has offered currency hedging for more than four decades. "We try to educate our clients because we want to be sure that when they enter into a hedge, they understand they are managing inherent risks the company faces, and that they are not using hedge products for speculation."

Hedging Oil Prices

Fuel prices exemplify the recent experience. From lows seen in the early days of the COVID-19 pandemic, fuel prices have rallied significantly to near all-time highs not seen since 2008 on the back of the war in Ukraine, and other unforeseen events. While they have recently moderated somewhat, the effect on a middle-market business can be painful.

Orefice cited the example of a mid-sized building services company. "They’ve got $3 million to $5 million of annual expense for fuel. This was a business that hadn’t ever hedged before," he said. "Instituting a hedge program enabled the company to protect against rising fuel costs. Had they not executed on their hedge program, they would have spent and additional $3.5 million on fuel over an 18-month period."

One form of hedging is the purchase of a futures contract—an agreement where the buyer of the futures contract locks in a price where they can purchase an agreed-to volume amount in the future. For a manufacturer that knows it will need a certain amount of a raw material input at a fixed time and wants that expense effectively to be fixed, a futures contract can be purchased.

But Orefice said that a different approach can be a prudent alternative for middle-market executives who must keep a broader focus. Futures contracts aren’t the only tool available for managing price risk, and they may not be best suited for what a company needs. Hedge products available through financial counterparties can provide much more customized solutions to managing commodities and foreign exchange price risk.

Futures vs Forwards: What’s the Difference

In addition to a futures contract, for example, companies may opt for a forward. With a forward contract, the terms are set at the time of agreement and the price does not fluctuate with the market. It also establishes when the asset will be delivered.

Whereas futures contracts are often used by speculators as well as for hedging, and are traded on public exchanges, a forward contract is a customized agreement between parties who are obliged to make good on the pact at the time specified. A supplier’s market price—or a currency--may rise or fall, but the "forward" ensures that the agreed-to terms will still apply. For both, the risk is contained.

Sometimes the hard duration of such an agreement is too inflexible to suit a business’s needs. If a company has a regular European customer, for example, but on an irregular transaction schedule, a "window forward" can take currency risk out of the equation. "This type of forward gives businesses the opportunity to deliver or to receive a currency within a certain date range at the same price," Orefice said. "If it does a one-month forward to receive euros at $1.10, it doesn’t matter if it’s delivered on day one or day 30, the client gets $1.10."

He added that a key advantage is that with window forwards, businesses are able to move dates. "They can be very customized to the client’s needs in terms of both prices and duration."

Easing the Hedge

The dollar’s rise in the past year is leading to some adaptations in the amounts being hedged. "What we’re starting to see is businesses that were doing 50% to 75% of their hedging in one year and leaving 25% open, are now moving a little bit back," Orefice said. "Their percentages have reduced in order to take advantage of the dollar move. We call that layering in hedges."

For example, middle-market businesses that last year would have hedged against three quarters of the value of their European currency exposure, have reduced their hedging program to around 50%. They are trying to time the market instead rather than taking advantage of the strong dollar.

"On the other side, an exporter facing losses from a higher dollar, for example, needs to hedge right away," Orefice said.

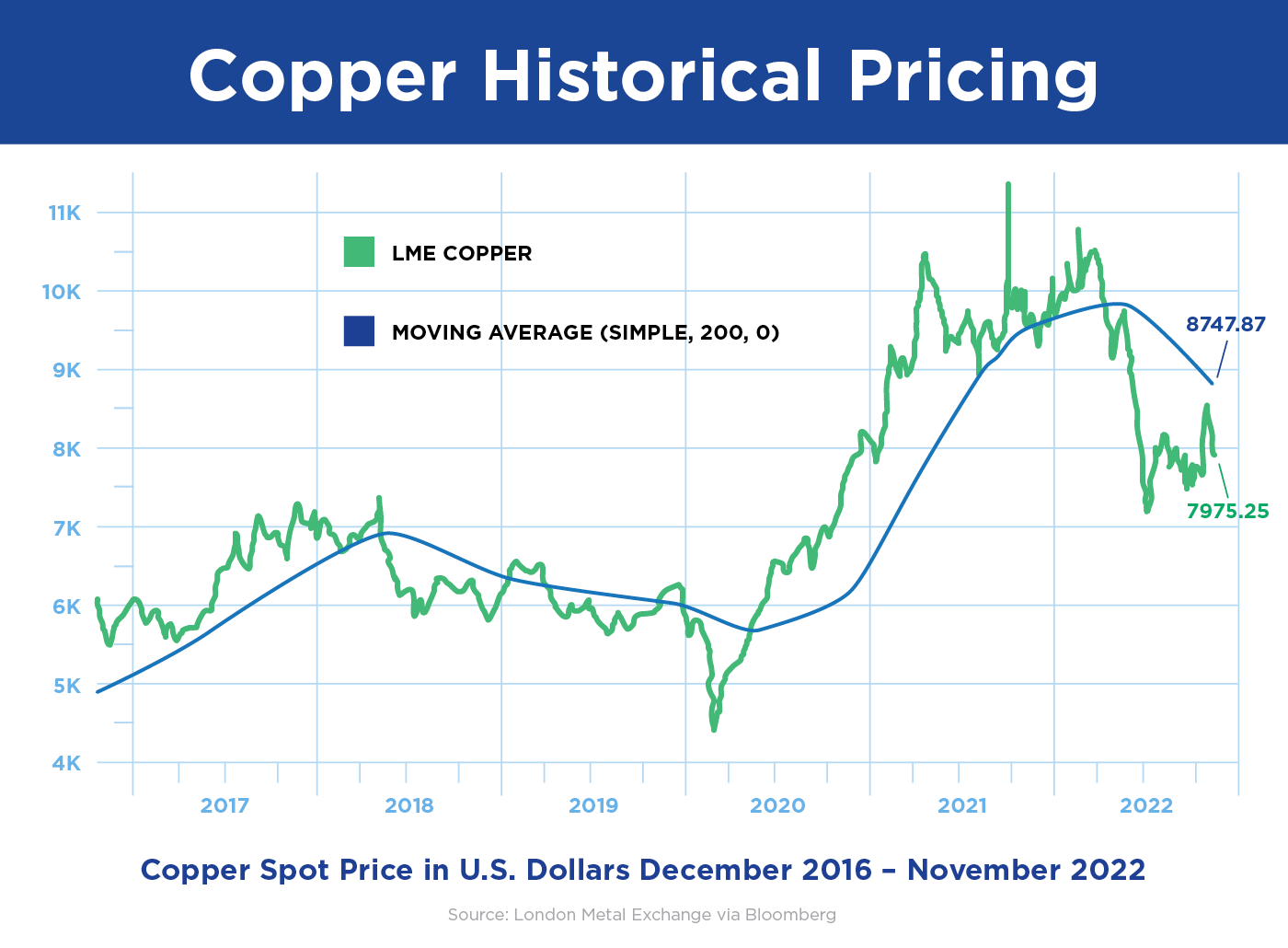

Commodities: Why Hedging Is So Important

Protecting against currency risk is just one of the available types of hedges companies can use to improve their bottom line. Another concern for manufacturers is commodity price risk.

Compared to currencies, commodity prices are a harder risk to manage. Spot metal prices are notoriously volatile—palladium, for example, saw the largest price increases in four of the past 10 years, only to be the biggest loser in 2021. But gold, which is the most commonly held commodity for speculation, has barely moved during that time frame.

By contrast, in recent years grain prices have spiked after years of lagging. And lumber notably rallied significantly higher twice since the COVID-19 pandemic began, only to fall back close to pre-pandemic levels. This is a reflection of surging home construction and home improvement projects initially, that were then followed by a decline due in part to rising interest rates.

And in 2021, long-slumping coal more than doubled in price and is still rising. Adding to all of this volatility in prices, shipping costs skyrocketed as the pandemic took hold, though they’ve since dropped precipitously.

Transcript available below graphic

Protecting Over the Long Term

With the dizzying swings in many commodity prices becoming the norm, "businesses are increasingly looking to protect against commodity price movements three to five years forward due to the current volatility," Orefice said.

Most companies are instituting hedge programs to protect against volatility due to what has become normal market conditions. And while companies should not necessarily institute hedge programs to try and manage risk due to unpredictable major market moving events—so called "Black Swan" events—a disciplined hedge program will protect them from these extreme risks as well. Further, protecting from the effects of market disturbances due to ongoing general conditions such as climate change for example, spotlights hedge opportunities that many firms are considering.

"Drought conditions are affecting agricultural prices across most of the U.S. and need to be considered as part of a hedge program," Orefice said. This is similar to supply chain and production issues affecting metals markets due to Chinese COVID restrictions and the Russian invasion of Ukraine. These are ongoing market conditions for which the risks need to be managed.

Because of the recent volatility, many middle-market businesses have realized they have to move quickly with hedging to avoid unanticipated losses. "Their decision-making time frame has dramatically come down," Orefice said.

Still, it’s important that all divisions within an enterprise be aligned on a hedge program’s benefits—and costs. What might suit the procurement teams could have the accounting office later seeing red. "If the CFO knows what a hedge does, but all of a sudden the hedge turns negative and the business has hedge liabilities, their accounting team needs to know that," Orefice said.

"Middle-market business should find a trusted advisor that can develop a hedge program to help the firm protect against and adjust to the current level of volatility," Orefice said. "What we can do is provide them with all the scenarios and analysis on what a hedge program would look like, whether that be for currencies, interest rates, or commodities. It’s a level of education that in these turbulent times can make a big difference to the bottom line."