Trends Transforming the Home Building Industry

As the demand for new construction homes increases, check out these trends transforming the home building industry.

As millions of Americans spend more time at home and many daily activities increasingly become virtual, there have been several shifts in the home building industry in response to these developments. Greater demand for larger houses to accommodate work from home, remote learning, and at-home exercise needs, along with increased homeowner focus on renovation projects are creating new and different demands for building supplies. These trends are driving changes in the home building industry.

Demand-Driven Shortage in Materials

The increase in remote work, remote learning, and virtual events from family gatherings to Zoom happy hours have homeowners craving more space. As Realtor.com has reported, remote workers are looking for a more dedicated home office than their kitchen table. Additionally, people are looking for ways to designate space for each member of the household and their activities. Rose Quint, Assistant Vice President for Survey Research at the National Association of Home Builders (NAHB) observed, “Because of the pandemic, we are seeing…builders…getting more requests for larger homes because people want more space.”

This desire for more space has led to significant materials shortages. One particularly hard-to-source material is lumber. Says Sucharita Kodali, principal analyst at Forrester, “It’s pretty basic economics. It’s supply and demand. If everybody wants something at the same time there’s just not going to be enough supply of it.”

The lumber shortage, in particular, has impacted the homebuilding industry significantly. Lumber price increases have caused new home costs to rise. NAHB reported that the price of an average new single-family home has risen by $16,148 due to increased lumber prices. With, industry observers predicting continued volatility of lumber prices, home builders are uncertain of how to move forward.

Industry advocates are taking action in response to the shortage too. NAHB has asked President Biden to take steps to address the lumber crisis. Their recommendations include negotiating a new softwood lumber agreement with Canada and urging domestic lumber producers to increase production.

Managing Lumber Price Risk

With this uncertainty in lumber markets, along with significantly higher prices, buyers of lumber, as well as suppliers, are looking for ways to manage their lumber price risk. Lumber is a commodity and has futures contracts that trade on the Chicago Mercantile Exchange. Companies can buy and sell futures contracts that enable them to deliver, or take delivery, of lumber in the future at a fixed price based on where the corresponding futures contracts are trading. This gives them an effective way to manage price risk and better plan and budget around their lumber exposure.

In order to buy and sell future contracts, companies will need to open a futures account, and they will be required to post margin in the form of cash collateral to secure the credit exposure. This eliminates any credit risk associated with the buyers and sellers of futures contracts making good on their commitment to fulfill their obligations through the futures contract. But it ties up cash flow, and the futures contracts have standard terms on contract volume, and settlement, and therefore are not very customizable.

To help their clients manage the price risk and volatility for commodities, including lumber, banks that have commodities risk management capabilities offer hedge products and solutions to their clients. These capabilities are similar to futures contracts in that they provide the same price protection, but they are much more customizable as far as structure, tenor, settlement terms, and volume. Further, the bank extends its balance sheet to reduce or eliminate the need for the client to tie up their cash flow by having to post margin. These commodities risk management products provide customizable solutions to bank clients so that they can manage their commodities price risk, remove volatility, and effectively budget their purchases or sales of physical commodities in the future.

Remodeling Projects On The Rise

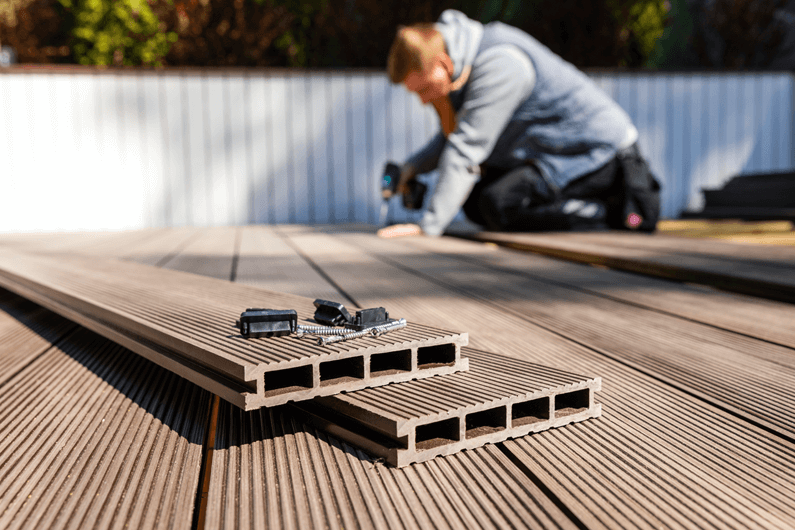

Many people have used their increased at-home time to take on remodeling projects. Last year, Home Depot and Lowe’s reported significant sales increases, indicating an uptick in home renovations. Many homeowners looked to build or expand outdoor spaces, with outdoor kitchens, in particular, becoming a popular addition. As people have searched for ways to safely socialize, home builders and contractors reported seeing clients investing more in outdoor spaces like patios, outdoor living rooms, and lounges.

Manufacturers of outdoor heat lamps and other heating devices have seen demand rise over the last year. Jordan Paschal, a spokesperson for Lowe’s Home Improvement told Consumer Reports, “Backyards and patios continue to serve as an extension of our homes during this time, and we’ve seen items including heat lamps, fire pits, and patio heaters become increasingly popular.”

However, materials shortages are also having an impact on remodeling, as those who’ve undertaken projects now find materials like windows and doors, appliances, and furniture in short supply. For instance, those focused on adding outdoor spaces are facing shortages of key items like outdoor heat lamps.

As a result of increased demand, some contracting companies are resetting expectations with customers. Karen Pearse, owner of Karen Pearse Global Direct, whose company distributes high-end materials to developers, architects, and designers described a project that required a specific type of marble. She elaborated, “Tariffs on Chinese marble went from 4.9 percent to 30 percent in the past year, and everything takes longer now, too.”

Adds Kirsten Gable, a kitchen and bath designer with Anthony Wilder Design Build, “It’s much harder to start projects quickly now, so we need to set expectations upfront”

Communication and expectation setting – both with suppliers and clients – are key to navigating materials shortages in the homebuilding industry.

Supply Chain Disruptions

While the homebuilding industry faced supply chain issues in previous years, the pandemic has tested those supply chains from several angles. In an August survey by Meyers Research 81 percent of builders stated that material supply disruption was likely to affect their planning.

In particular, those builders that rely on countries like Italy, Spain, and China for building supplies were impacted significantly. Pandemic-related restrictions caused shipment delays, which resulted in longer lead times for homebuilding projects. Homebuilders are taking specific steps in order to start and finish projects on time, or as close to on time as possible.

As supply chains struggle to keep up with demand, homebuilders are looking to diversify their suppliers. Speaking to Construction Dive in October, Daniel Pomfrett, vice president of Cumming Corp, a Los Angeles-based project management and cost consulting company noted, “The days of having one material supplier are gone,” he said. “We’re seeing clients setting up three separate suppliers, in different geographic locations, where in the past they may have had just one or two. Some are even getting as many as five in place.”

Additionally, lumber price increases are causing some builders to consider using alternative materials in home construction. The industry publication BUILDER Online has reported homebuilders opting for an offsite building approach and using pre-built framing components like wall, floor, and roof panels, which can potentially save homebuilders time and money on projects. Large homebuilders like PulteGroup are embracing the precision manufacturing approach. The company recently acquired Jacksonville, Florida-based Innovative Construction Group (ICG), a provider of offsite building solutions for single and multifamily construction.

Such flexibility will be valuable for helping homebuilders respond to the challenges posed by supply chain disruptions.

Conclusion

Increased demand and low interest rates have made housing one of the few industries that has weathered the pandemic-related economic downturn. The strong demand for housing, coupled with pandemic restrictions, have impacted homebuilders and everyone in their supply chain. Communication and resilience will be vital in helping the industry navigate the changing industry landscape. Contact your Relationship Manager or to learn more.