Top Trends in Treasury Management

Digitizing payables and receivables can deliver benefits beyond operational efficiency.

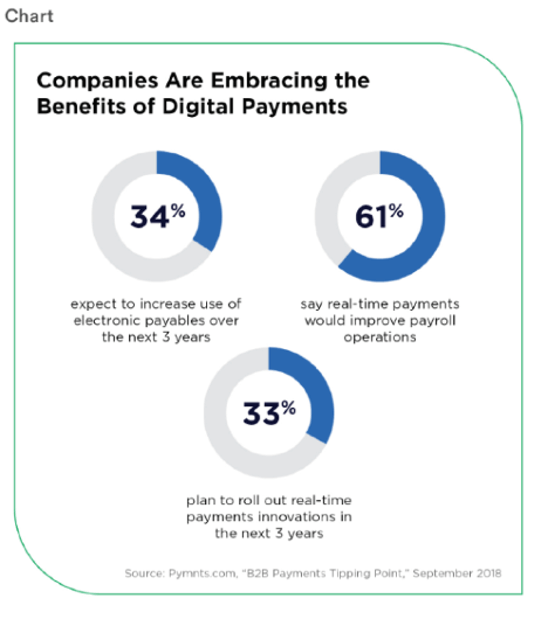

Companies are increasingly automating and digitizing key treasury functions, such as accounts payable and receivable, to increase efficiency and improve cash flows—but that only scratches the surface of potential growth-driving benefits.

Today, firms armed with new technology can gather and analyze the reams of data embedded in payment transactions for insights that can fuel growth, according to Bridgit Chayt, head of commercial payments and treasury management at Fifth Third Bank.

"Our clients are moving to digital not only for payment efficiency but for data efficiency as well," she says. "Having digital access to their own data stimulates their business growth and builds stronger decision frameworks within their company."

Source: Pymnts.com, "B2B Payments Tipping Point," September 2018

For instance, a company could mine transaction flows to identify loyal customers or those who are ramping up purchases. Those customers may be good targets for additional outreach, to deepen existing loyalties or expand relationships. Transaction data can also give companies visibility into which clients are slow to make payments and identify potential delinquency problems before they turn more serious.

"Ironically, companies are finding digital automation provides better, more frequent personalized outreach with their customers and suppliers," Chayt says. "As a result, they’ve been able to leverage new opportunities to monetize those data-driven insights."

Navigating Disruption

The COVID-19 pandemic accelerated the digital transition toward automated payables and receivables. In addition to the promise of increased efficiencies and more actionable data, companies realized technology could help them navigate the challenges they, their clients and their suppliers faced during a highly disruptive period.

"Overnight, the conversation turned to ‘How do I take care of my customers and suppliers?’ and ‘How do I maintain my business controls when nobody is in the office?’" Chayt says.

For customers and suppliers, partnering with their bank for managed payables and receivables solutions can instill confidence among the firms they interact with—and not just during a pandemic. For instance, Fifth Third worked closely with utilities and insurance companies to provide higher levels of automation so their customers could feel more confident their bill and premium payments will arrive on time.

"In times of disruption, you need to know your lifeline payments are being made," Chayt says.

Whether or not their employees have returned to the office, companies continue to deal with a growing list of challenges, including labor shortages that can disrupt operations. Chayt notes that while several business clients reached out for help finding candidates to replace key personnel, Chayt and her team may suggest technology solutions instead.

"A managed service solution for payables or receivables can minimize the reliance on staff to keep cash management activities running," she says. "Customers need to be able to deploy their resources to generate the highest return. Automation provides the flexibility to make this happen."

Beyond treasury management and advanced payment capabilities, "Fifth Third provides sophisticated capital markets and financing solutions as well as strategic advice. This wide range of services and depth of our experience enables us to address the full spectrum of our clients’ needs," says Kevin Lavender, head of commercial banking at Fifth Third Bank.

Beyond the CFO

The technology tools companies are using today to automate payables and receivables do more than manage the movement of money: They’re robust platforms that use artificial intelligence and machine learning to handle purchase orders and invoices as well as real-time reconciliation. These new tools also can collect data and feed it directly into enterprise resource planning software and analytics engines to help companies make better decisions.

Application programming interfaces, or APIs, are a key feature of these platforms. Companies large and small rely on APIs to manage the data flowing between their treasury departments and their banks. While smaller enterprises may work with a handful of banks—one for cash management, say, and another to manage lending needs—large companies may work with dozens of financial institutions.

APIs allow companies to automate the collection of data from each of those financial institutions, turning a time-consuming task into a data haul companies can quickly leverage for valuable insights.

Indeed, one of the most compelling treasury management trends is chief financial officers building alliances across their organizations, Chayt says, helping make sure that the information gathered from automated payables and receivables is used to elevate the customer experience and pursue new avenues for growth.

"It’s not just posting to the general ledger or the checkbook of payables," Chayt says. "By coming together and collaborating on payment strategy, organizations do a better job acquiring and retaining clients."

"There’s a strong desire, especially among publicly held companies accountable to shareholders, to treat the environment with respect and increase sustainability by eliminating paper," she says. Learn more at 53.com/Commercial

"Ironically, companies are finding digital automation provides better, more frequent personalized outreach with their customers and suppliers. As a result, they’ve been able to leverage new opportunities to monetize those data-driven insights." — Bridgit Chayt, Head of Commercial Payments and Treasury Management, Fifth Third Bank